Only about one in three first-generation family-owned businesses successfully transfer to the children. A quarter of those businesses fail to transition to a third generation. Why such dismal results?

In my experience, it's because the founder did not adequately plan for succession. The succession program was not anchored by a clear "inside out" reason.

Applying a Model

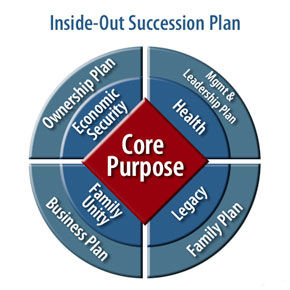

Applying a ModelI coined the concept of Inside-out Succession planning from the realization that owner-entrepreneurs must first decide WHY to develop a succession plan. They must ask and answer "What is my core purpose?" Only then can a plan truly succeed.

What is that core purpose? Why would an entrepreneur plan for succession? Age? Family pressure? The feeling that "it's time to pass the baton?" Yes ... and no.

Yes, there can be different core purposes. They represent the inside ring of the model and include economic security, health, family unity and legacy. These four core purposes adequately identify the range of motivations for succession planning, which we will discuss in a moment.

But, no, a core purpose will not produce a successful succession plan as long as it remains vague or undefined, such as "I'm getting too old for this." The entrepreneur who has a clear purpose is motivated to give direction to the plan. Once motivated, the entrepreneur can integrate that core purpose into the four different, yet related, plans. These four plans are the perimeter of the Inside-out Succession Plan model, which I will discuss in Part 2.

Missing the Bull's-Eye

The core purpose is the bull's-eye to aim for and hit. Knowing the core purpose is the entrepreneur's critical first step in developing a succession plan.

I believe that many business families confuse succession planning with ownership planning. Ownership planning is just one of the four processes at the perimeter of the Inside-out Succession Plan model. Entrepreneurs go directly to an ownership plan because it is a common myth in family-business circles that the primary reason for completing ownership and estate planning (their concept of succession planning) is to avoid taxes. So by default (and unconsciously) the core purpose for succession plans becomes "avoiding taxes."

In my experience, it is not unusual for technical professionals to support this notion. They plan from the perimeter, or "outside in," using one of the areas depicted on the outer ring of the model.

When tax planning and tax savings replace the core purpose, a tax-driven program can create problems for the family. I frequently see ownership of stock gifted prematurely to younger-generation adult children, only to have those young adults say that they want to be bought out when it becomes time to plan for succession.

That's just one example of why the entrepreneur must first have a clear, underlying core purpose (bull's-eye) that drives succession planning. Let"s look more closely at these four different core purposes.

Economic Security

Owner-entrepreneurs who are in their 60s and 70s are often quite aware of the need for a financial exit strategy that guarantees their lifestyle. For years they put everything into the business they created and now need concrete assurance that they and their spouses can be sustained without putting the business or themselves at risk. Developing a financial exit strategy is critical for a family business. Economic security can be a major factor that includes a financial exit strategy, but succession planning should consider more than tax planning or tax savings.

Health

This can be a highly emotional motivation for succession planning because, whether stated or not, owner-entrepreneurs are implying that they are "playing the back nine." This can create fears: fear that they have to "let go," fear that they are "being forced out," even fear by others that their loss of leadership could harm the company.

To help overcome their fears, I developed a process called "

The Last Challenge of Entrepreneurship." Essentially it means that entrepreneurs need not leave their companies. Instead, they need to change their job descriptions so they become designers and champions (along with their adult children) of the new ownership and leadership arrangement for their business. They are not "promoted out" but "promote the outcome."

Legacy

There comes a time in almost everyone's life when the person wonders, or at least thinks about, whether he or she has made a difference in the world. It's as natural as aging and doubly likely for individuals who started and sustained their own successful businesses. Harvard Business School's Laura Nash defines legacy as "your gift to the future to help others find future success." Nash is referring not only to the financial aspects of legacy but also to nonfinancial ones, such as family values, heritage, service and philanthropy.

This also implies another side of legacy: how we want to be remembered. When most entrepreneurs contemplate retirement, they begin to wonder whether others in the family appreciate what they, as business founders, have done for them.

Most entrepreneurs will deny it, saying they do not need to get or care about or have concerns about getting that kind of validation from their families. As a family-business consultant with a psychology background, I can state with confidence that this is a deep, significant and common desire to consider candidly when determining a core purpose for succession planning. Incidentally, this is also what younger-generation adult children are looking for - parental approval and appreciation for joining the family business.

Family Unity

No entrepreneur wants the family torn apart by business or financial differences. So to preserve family relationships, many families mistakenly avoid talking about their differences. I call this "Hubler's Spec of Dust Theory." Family members won't bring up differences - they keep sweeping them under the rug - because it might upset family gatherings, events or holidays. Yet by not discussing differences, they inadvertently create the very pile of dust they are trying to avoid. Thus, the core purpose of maintaining family unity could become a key driver for family-business succession planning.

Powering Purpose

An entrepreneur needs to determine what core purpose is the motivating reason for a succession plan. Is it economic security? Health? Legacy? Family Unity? Some combination?

Once that decision is made, the entrepreneur becomes the architect for building the succession plan. And with the involvement of adult children, the transfer of the company becomes an embracing, thoughtful process with a clear and successful outcome.

In

Part 2 we will delve into succession plans and priorities more closely.